Monday | Day 1

Tuesday | Day 2

Wednesday | Day 3

MONDAY, DECEMBER 1

4:00 PM | Registration Opens

EVENING PROGRAM

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

4:30 PM | HGF Studios

Delta Documentary

5:00 PM | Networking Reception

5:00 PM | Welcome Reception

6:00 PM | OPENING NIGHT

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

8:05 PM | Future Proofing Crypto Literacy

Digital currencies are no longer fringe: globally, around 559 million people now own cryptocurrencies, representing roughly 9.9% of the internet-connected population. At the same time, a recent review by the OECD found that in 39 economies average literacy scores for basic money skills and digital financial tools stood at only 53 out of 100 — leaving many people ill-equipped to deal with crypto’s unique risks.

The opportunity is significant. Emerging markets are driving usage: for example, the TRM Labs “2025 Crypto Adoption and Stablecoin Usage” report shows the U.S. market’s transaction volume jumped about 50% between January and July 2025 compared to the same period in 2024. Stablecoins alone now make up around 30% of all on-chain crypto transaction volume, having surpassed $4 trillion dollars in 2025.

For communities historically underserved by traditional banking, this signals potential: faster cross-border remittances, alternate savings and payment rails, and new forms of participation in the digital economy.

But here’s the caveat: many of these tools come without the familiar guardrails of consumer protection, and widespread understanding of how tokens work, how wallets are secured, or how to evaluate risk remains low. The OECD flagged that many crypto-asset users “with low digital financial literacy, low risk aversion or limited financial resilience may be particularly vulnerable.” Similarly, the U.S. Government Accountability Office (GAO) noted that while digital financial services offer “greater access and customization,” they also “pose risks” because convenience can lead to risky behavior.

Understanding these dynamics is key. On the opportunity side: programs tailored to community contexts can teach people how digital assets fit into budgets, how to use wallets securely, how to spot scams, and when to hold back. Incorporating crypto into broader financial-literacy work means making emerging technology less mysterious and more navigable. On the challenge side: educators must avoid hype, ensure materials are up to date in an inherently fast-moving space, and account for uneven access to reliable internet and trusted devices — conditions many underserved populations still face.

What tools and educational supports will help people recognize when digital finance is working for them — and when it might undermine their financial resilience? How do we build materials and systems now that withstand technological change, not just today’s hype? And how do we ensure inclusion is real, not just a buzzword, so that more people can approach digital money with both hope and caution.

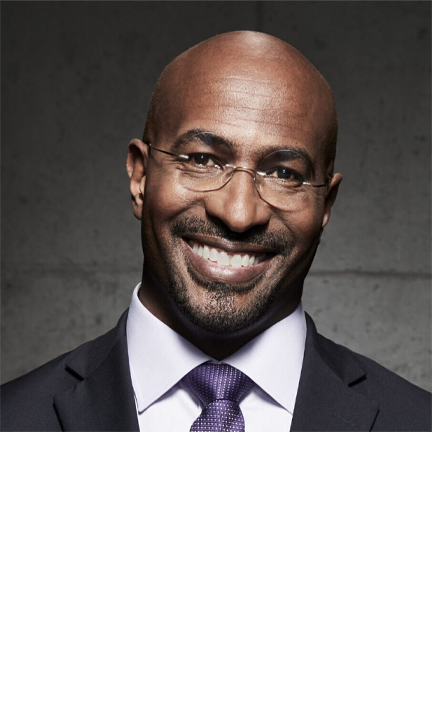

Moderated by:

9:30 PM | PROGRAM CONCLUDES

TUESDAY, DECEMBER 2

7:00 AM | Registration Opens

MORNING AGENDA

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

7:30 AM | Continental Breakfast

8:50 AM | OPENING PLENARY

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

11:00 AM | STRAIGHT TALKS

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Author Talks Jonathan Eig, Pulitzer Prize-winning author, KING

Location: HGF Studios

Meet author Jonathan Eig, as he discusses his Pulitzer Prize-winning book, KING. Eig is the bestselling author of six books, four of them New York Times best sellers. He was awarded the Pulitzer Prize in 2024 for his most recent book, King: A Life, which was hailed by The New York Times as the “monumental” and “definitive” biography of Martin Luther King Jr.

Eig’s previous book, Ali: A Life, won a 2018 PEN America Literary Award. His works have been translated into more than twenty languages. He served as a producer on the PBS documentary Muhammad Ali, which was directed by Ken Burns.

The Birth of the Pill, Eig’s 2013 book, will be produced as a play next year by Chicago’s the TimeLine Theatre Company.

Eig began his writing career at age 16, working for his hometown newspaper, The Rockland County (N.Y.) Journal News and went on to work as a reporter for The New Orleans Times-Picayune, The Dallas Morning News, Chicago Magazine, and The Wall Street Journal. He lives in Chicago with his wife and children. He is currently at work on a biography of George Soros.

Moderated by:

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Future Proofing Women’s Wealth

Location: Leadership Stage

Women control more than $31 trillion in global spending power yet continue to face systemic barriers that limit their ability to build, preserve, and transfer wealth. In the U.S., women are responsible for nearly one-third of all GDP but still earn only 82 cents for every dollar earned by men. Beyond wages, women entrepreneurs—who now own more than 12 million small businesses nationwide—receive less than 5% of total venture capital funding and face persistent inequities in lending, mentorship, and access to growth opportunities.

These disparities not only limit individual advancement—they suppress innovation, job creation, and community development. When women business owners thrive, they hire locally, reinvest in their neighborhoods, and act as multipliers for social and economic progress. The data are clear: closing the gender wealth and funding gaps could add up to $7 trillion to global GDP, making the financial empowerment of women one of the most strategic economic imperatives of our time.

Empowering women to build and sustain wealth through entrepreneurship, investment, and leadership is about more than equality—it’s about economic resilience and generational impact. By helping women access capital, navigate risk, and scale their enterprises, we enable families and communities to weather economic shifts and create lasting prosperity.

This Straight Talk session will explore what it truly means to “future proof” women’s wealth in an era of rapid technological, demographic, and cultural change. Leaders from across finance, philanthropy, technology, and small business will share forward-thinking strategies to ensure women are not just participants in the economy—but architects of a more inclusive financial future.

We’ll examine how public policy, private capital, and entrepreneurial ecosystems can come together to dismantle barriers and unleash the full economic potential of women as innovators, investors, and wealth creators, including:

-

What tangible changes—such as pay equity policies, small business lending reforms, or targeted investment incentives—can have the greatest immediate impact on women’s wealth creation?

-

How can technology, fintech platforms, and alternative lending models be leveraged to expand access to capital for women entrepreneurs, particularly in underserved communities?

-

What role should corporate procurement programs, venture funds, and financial institutions play in ensuring equitable investment and contracting opportunities for women-led businesses?

-

How can financial education, mentorship, and entrepreneurial networks better equip women to grow their enterprises, manage risk, and build multi-generational wealth?

-

What innovative frameworks—such as employee ownership models, cooperative investing, or community capital networks—show promise in helping women future-proof their financial independence?

-

How can we ensure that women’s wealth strategies emphasize not just income today, but also asset-building, business succession planning, and intergenerational wealth transfer for the future?

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Future-Proofing Inclusive AI

Location: Magnificent 6

Inclusive AI can be a force for shared prosperity—helping small businesses compete globally, expanding healthcare access to underserved regions, and personalizing education for students of all backgrounds. Artificial Intelligence is no longer experimental—it’s shaping decisions in hiring, lending, healthcare, customer service, and supply chain management.

But if not designed thoughtfully, these systems can unintentionally reinforce bias, exposing companies to reputational, legal, and operational risks. Think of the power of algorithms alone: from the news we read and the music we stream, to the products we buy and even the jobs we see online, algorithms quietly shape much of our daily lives. Studies show that more than 60% of global web traffic now flows through algorithm-driven platforms, while 71% of Americans say they get at least some of their news from social media feeds. These digital engines offer incredible convenience and efficiency, but they can also reinforce existing biases, narrow the information we see, and even impact economic opportunity by filtering which ads, job postings, or financial offers reach certain communities.

To unlock the full promise of AI, the technology must work for everyone. Research from major universities has shown that algorithmic bias in areas like credit scoring or hiring can cost underrepresented groups billions annually in lost opportunities—but with smarter design, greater transparency, and broader input, these systems can instead drive equity and economic growth.

Key Questions:

What steps can platforms and developers take to make algorithms more transparent, so people better understand how their information, choices, and opportunities are being shaped? How can we redesign platforms to reduce bias—especially in critical areas like job recommendations, credit scoring, or housing—so that technology expands opportunity rather than limits it? As AI and algorithmic systems become more advanced, what safeguards and innovations are needed to balance personalization and efficiency with fairness and inclusion? How do algorithms influence economic opportunity—such as which jobs, loans, or educational programs people see—and what can be done to make access more equitable?

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Future-Proofing Financial Longevity for Generations: Insights from AARP

Location: Magnificent 7

With longer lifespans and rapidly changing economic landscapes, financial preparation for longevity has never been more important—or more challenging. The intersection of aging, longevity, and economic inequality demands attention from leaders across sectors. This session brings together leaders across industries to explore innovative approaches to wealth building and transfer as the most significant intergenerational wealth transition unfolds.

Presented by AARP, the nation’s largest nonprofit and nonpartisan organization dedicated to empowering Americans as they age, this gathering will drive concrete solutions for building inclusive economic opportunity across generations and amid deep and persistent disparities in wealth and financial security. Participants will explore strategies to strengthen intergenerational wealth building through homeownership, entrepreneurship, education, and equitable financial systems while addressing the structural barriers that have long restricted access to opportunity.

Join us in shaping a future where wealth is built and shared across generations—advancing equity, strengthening communities, and contributing to a more resilient nation.

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Future-Proofing Small-Business Success

Location: Magnificent 3

Small businesses are the backbone of the global economy, driving over 44% of U.S. GDP and creating two-thirds of net new jobs in the United States alone. Yet, these critical engines of innovation and opportunity face mounting pressures: limited access to capital, rapid shifts in technology, supply chain vulnerabilities, and growing competition in digital marketplaces. Globally, more than 40% of small businesses report struggling to secure financing, a barrier that stifles growth and limits the economic potential of entire communities. Addressing these challenges is more than an economic necessity—it’s an opportunity to unlock resilience, job creation, and inclusive prosperity.

Future-proofing small businesses means building ecosystems that help them adapt, grow, and thrive. From digital tools that streamline operations, to mentorship programs and targeted financing that empower underrepresented founders, innovation is reshaping what small business success can look like. Financial institutions, technology partners, policymakers, and community organizations all play a role in creating environments where businesses can compete and lead in an evolving economy.

Key Questions:

What models are proving effective in helping small businesses access capital and scale sustainably? How can technology—such as AI tools, e-commerce platforms, or digital payment systems—help small businesses compete and grow in the digital economy? What lessons from recent disruptions—like supply chain challenges or market volatility—can help small businesses future-proof their operations? How can corporations, community organizations, and policymakers better collaborate to build ecosystems that support small business growth and innovation?

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

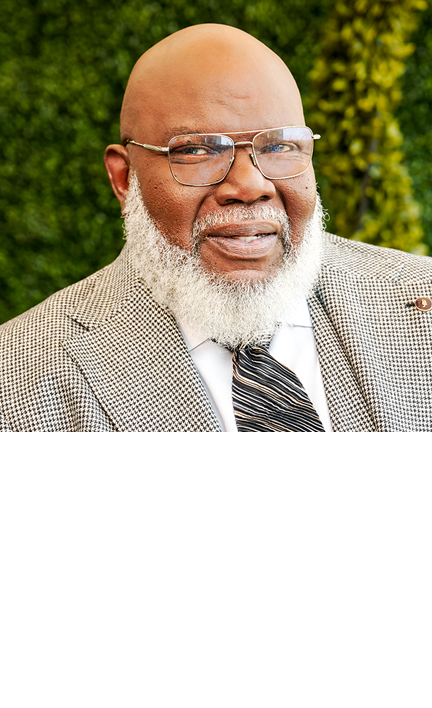

Future-Proofing Our Institutions

Location: Magnificent 5

Our most trusted institutions—banks, schools, community organizations, and even government systems—are being tested by rapid technological change, shifting demographics, and evolving public expectations. Institutions are being challenged by demographic decline, governance gaps, and issues of trust in their very existence. The current conditions call into question whether these cornerstones of society can evolve to meet today’s challenges while preparing for tomorrow’s opportunities.

Weak or outdated institutions limit GDP growth, particularly in under-resourced areas, undermining job creation, wage advancement, and upward mobility. Structural inefficiencies, corruption, and demographic pressures hinder investment in innovation, hinder inclusive policy design, and skew opportunity toward better-served communities. During shocks—like financial crises or pandemics—regions with institutional shortcomings suffer deeper, longer setbacks, reducing economic stability and opportunity. Without investment in governance and institutional modernization, disparities grow. Regions that can’t adapt are increasingly left behind in the global economy.

Key Questions:

How do we ensure our institutions aren’t just prepared for the future but actively shaping it for the better? What role can AI and digital tools play in helping institutions evolve, and how can they expand access and opportunity? Which of these critical pillars of society can remain resilient, relevant, and responsive in a future defined by disruption? What practical approaches for integrating technology, improving trust and transparency, and aligning mission and impact to meet the needs of the next generation?

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Future-Proofing Financial Health

Location: Magnificent 4

The definition of financial inclusion is being rewritten. Today, over one-third of U.S. adults use more than one fintech app to manage their finances, and nearly half of consumers now describe themselves as “partially banked”—maintaining relationships with both traditional banks and digital providers. The result is a rapidly evolving ecosystem where access, trust, and choice intersect in new ways.

Consumers are also “unbundling” their wallets, mixing fintech platforms, peer-to-peer tools, and embedded financial products to meet diverse goals. Traditional milestones like homeownership and retirement are no longer the only measures of financial success. New behaviors—splitting rent across apps, using buy-now-pay-later for essentials, or investing through mobile-first platforms—reflect a generation redefining what financial security looks like.

This Straight Talk session explores how these shifts are reshaping financial access for households and small businesses alike. Grounded in both data and lived experience, the conversation will challenge assumptions about inclusion and innovation—asking how institutions, communities, and technology can work together to future proof financial well-being for the next decade and beyond. Join a discussion grounded in data and lived experience to redefine financial health and ensure strategies and solutions meet the needs of tomorrow’s consumer.

AFTERNOON AGENDA

12:10 PM | LUNCH PLENARY

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

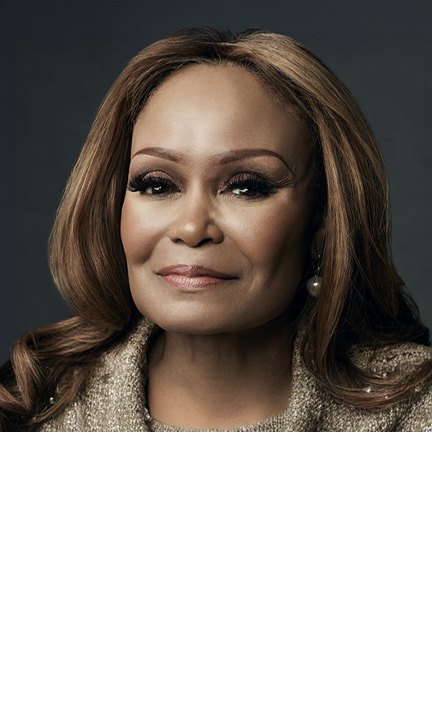

12:35 PM | Future Proofing the Sports Economy: Brand Building into the Future

Future proofing the sports economy begins with acknowledging that its traditional pillars—ticket sales, broadcast rights, sponsorships and merchandise—are no longer guaranteed anchors. Demand is still strong, and the global market continues to grow, but the way fans consume sports is fragmenting. Younger generations are consuming sports differently, live attendance is competing with at-home digital experiences, and fans expect direct connection, authenticity, and real-time access. At the same time, brands must navigate the rise of player-driven content, new technologies, evolving social issues, and a crowded entertainment market.

This means that the stability of the sports economy depends on building models that can thrive even when the old assumptions about viewership or stadium loyalty don’t hold. Long-term resilience comes from diversifying revenue, investing in digital infrastructure and treating fans as participants rather than spectators.

Atlanta Hawks Chief Marketing Officer Melissa Proctor takes the main stage to share how her journey—from ball girl to CMO—shapes the way she thinks about the future of the Hawks brand. Drawing from her deep connection to the organization and years of experience in sports marketing, she discusses what it takes to keep a franchise grounded in its history while preparing for what’s next.

How do you stay relevant to younger fans? How does your journey inform how you approach your role? How do you adapt to new technologies without losing the human connection that makes sports meaningful? How does the team stay true to the community that built it, even as the game and the business evolve?

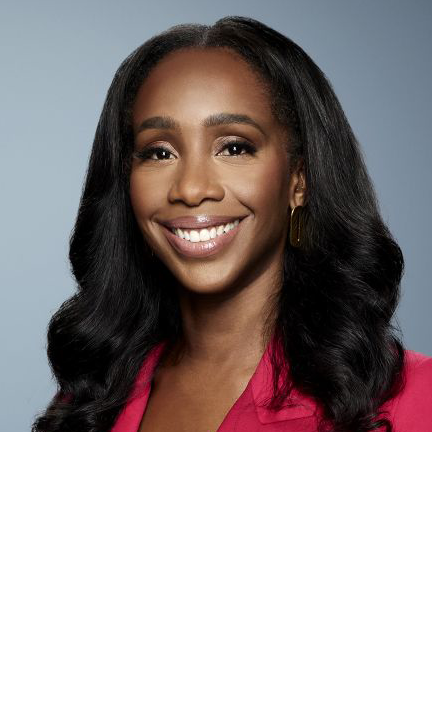

Moderated by:

1:00 PM | Future Proofing the Sports Economy: Inside the Owner’s Suite

Sports have always been more than a game — they’re powerful engines of economic growth, cultural connection, and community pride. As the global sports business model evolves through technology, new media, and generational change, today’s team owners are being called to lead with business acumen at the international level while maintaining community connection at the local level.

Globally, the sports market is projected to surpass $600 billion by 2027, fueled by digital media, data analytics, and fan-driven innovation. Yet beyond revenue, teams are increasingly measured by their community footprint. In the U.S. alone, professional sports franchises generate over $80 billion annually in local economic activity, creating thousands of jobs and spurring urban revitalization through stadium districts, small business growth, and infrastructure investment.

The session will explore:

- Building: Sharing owners’ personal “builder” stories—how they built their businesses, their franchises, and their connections to the communities they operate in.

- Economic sustainability and long-term franchise value amid new media models, NIL reform, and fan behavior shifts.

- Technology and innovation, including how digital platforms, data analytics, and AI are reshaping fan engagement and team operations.

- Community impact, examining how major sports organizations are investing in education, workforce development, and neighborhood revitalization—ensuring that local communities benefit directly from sports-driven growth.

Moderated by:

1:30 PM | IDEA LABS

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Future Proofing Content Creation

Location: HGF Studios

Welcome to the creator economy — where storytelling meets strategy, and creativity has become one of the most powerful currencies of our time. In a world driven by algorithms and constant reinvention, content creators aren’t just entertaining audiences — they’re building movements, shaping culture, and creating new paths to economic freedom.

-

How do you turn creativity into consistent income — and purpose into a platform?

-

How can creators protect their work, scale their earnings, and still stay authentic?

-

And how do you build a brand that not only thrives today, but also stands the test of tomorrow’s trends?

Whether you’re just a social media user, a curious entrepreneur, or a brand looking to connect in new ways — this session will challenge you to see the behind-the-scenes of content creation and how it can be used as tool for empowerment, education, and lasting impact.

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

SMALL BUSINESS POP-UP: Future-Proofing Access to Capital reimagined with Truist

Location: Leadership Stage

Capital is the fuel of innovation, entrepreneurial, and small business growth—but access to that fuel remains uneven. As a small business owner, you want to see your business thrive while you excel at serving your customers. When it comes to funding, you want to make sure the financing process doesn’t distract you from those goals. Learning why businesses borrow, how the lending process works, and where else to turn for funding, makes for a smoother, smarter, and often more successful outcome.

A good financing outcome starts with the confidence that securing funds is the right path to achieve the business results you want. The best source of funds will depend on many factors, like your development stage, amount of equity invested, profits accumulated, and funding needed. And your preparation for the financing process will often determine your success in securing capital. By future-proofing access to capital, we can fuel entrepreneurial innovation, grow stronger small businesses, and create a more resilient economy that works for everyone.

Powered by Truist, this session will deliver small business owners understanding of financing options and the borrowing process to put you in the best position to get the funding you need.

Questions:

- Should I seek funds? Where do I start?

- What’s the best financing option for my business?

- How can I prepare my business to grow?

- How are innovative models—such as impact funds, community development grants, government funded lending, and public-private partnerships—helping to expand access to capital?

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Future-Proofing Financial Access

Location: Magnificent 6

Financial access is more than a convenience—in an economy that’s 70% consumer spending, it’s a foundation for economic growth, upward mobility, and long-term prosperity. While technology has helped improve access, more than 1.4 billion adults worldwide remain unbanked, and many more rely on costly alternatives such as check-cashing services or payday loans. In the United States alone, an estimated 20% of households are underbanked, limiting their ability to save for emergencies, build credit, or access affordable lending. These gaps are not merely a challenge for individuals; they limit small business formation, dampen consumer spending, and slow economic growth.

Barriers to access often stem from a lack of affordable products, low financial literacy, geographic isolation, or mistrust of institutions. These challenges are especially acute in rural communities, among women and minority entrepreneurs, and in lower-income neighborhoods where traditional bank branches are disappearing. Closing these gaps could unlock billions in economic activity: studies have shown that increasing financial inclusion by just 10% can lead to a measurable boost in GDP and job creation. Ensuring access is not just a social goal—it’s a strategic investment in community and national economies.

Technology is transforming how individuals and businesses engage with financial services. Mobile banking, digital wallets, real-time payments, and AI-powered credit scoring are helping to lower barriers and reach people historically left out of the system. At the same time, these innovations bring new responsibilities for security, privacy, and equity to ensure that digital solutions close, rather than widen, the divide. Partnerships between fintech firms, established banks, nonprofits, and policymakers are proving that collaboration is key to making progress at scale. By future-proofing financial access, we can empower households to build savings, help small businesses thrive, and ensure that the benefits of economic growth reach every corner of society.

Key Questions:

What steps can financial institutions and fintech companies take to build trust in underserved communities that have historically been excluded or faced predatory practices? How can we ensure that women, rural communities, and small businesses are not left behind as financial services become increasingly digital? Which partnerships or policy changes have shown the greatest impact on widening financial access, and how can they be scaled to reach more people and regions? How can digital wallets, real-time payments, and AI-driven credit scoring increase access to affordable credit while maintaining fairness and security?

Moderated by:

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Future-Proofing Aspiration

Location: Magnificent 4

Aspiration is the engine of upward mobility and economic progress—but today, many communities are grappling with shrinking optimism. Studies show that fewer than 50% of young Americans believe they will be better off than their parents, a sharp decline from previous generations. This erosion of belief doesn’t just dampen individual dreams; it stifles entrepreneurship, innovation, and workforce participation—limiting the economic potential of entire communities. Research indicates that regions with higher levels of educational attainment and aspirational confidence see faster GDP growth and lower unemployment, underscoring that cultivating ambition isn’t just motivational—it’s economically transformative.

Future-proofing aspiration means connecting belief with access—ensuring that pathways to education, wealth-building, entrepreneurship, and social mobility are visible and attainable. Programs that pair mentorship with skill-building and financial literacy have been shown to boost small business formation, household savings, and long-term earning potential. This session will explore how businesses, educators, policymakers, and community leaders can collaborate to inspire confidence, expand opportunity, and nurture a culture of possibility—transforming personal aspirations into engines of growth that benefit individuals, families, and entire economies.

Key Questions:

How can businesses, educators, and policymakers better align programs that connect skills, mentorship, and financial literacy to real economic opportunities? How can stories of success—especially from a range of backgrounds—be used to spark aspiration and show that opportunity is within reach for everyone? How can we better track the economic and social benefits of aspiration-building programs to guide investments and policy? What strategies can be used to rebuild belief in upward mobility, especially among young people who feel left behind?

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Future-Proofing Homeownership

Location: Magnificent 3

Homeownership remains one of the most powerful engines for wealth creation and community stability. Yet millions of families continue to be priced out or denied access to mortgage credit, widening the wealth gap and threatening a central pillar of the American Dream. In the United States, homeowners hold over $35 trillion in equity, which represents between 50–70% of net worth for most middle-income families. At the same time, first-time buyers face rising prices, limited inventory, and lending barriers—challenges that disproportionately affect younger, minority, and low-income households.

Persistent racial and generational disparities underscore the urgency for action: Black and Hispanic households continue to experience mortgage denial rates nearly double those of white applicants with similar incomes, and the homeownership gap between Black and white families remains close to 30 percentage points—roughly the same as it was in 1968. These inequities don’t just affect individual families; they slow small-business formation, reduce local tax bases, and limit opportunities for intergenerational wealth transfer that drives economic mobility.

Technology is also playing a critical role—streamlining underwriting, expanding alternative credit assessments, and improving access for first-generation buyers. This Idea Lab will spotlight practical solutions that rethink how people enter and sustain homeownership. We’ll explore innovations such as shared-equity models, down-payment assistance programs, credit-building initiatives, and new mortgage products that better reflect today’s workforce realities.

Participants will work alongside experts to generate actionable strategies that can scale nationally and locally. The goal: to help more families not only buy homes but keep them— building equity, strengthening communities, and ensuring that homeownership remains a cornerstone of opportunity for generations to come.

Key Questions:

What innovative financing tools show the most promise in helping first-time and historically excluded buyers enter the market? How can we address disparities in mortgage approvals to close the homeownership gap and increase intergenerational wealth building? Beyond financing, what creative approaches to increasing housing supply could help keep homeownership within reach for working families? What policies or products can help families not just buy a home but keep it during periods of economic volatility, rising interest rates, or unexpected hardship? How can lenders, developers, community organizations, and policymakers better collaborate to scale solutions that make homeownership more affordable, equitable, and sustainable nationwide?

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Future-Proofing Work

Location: Magnificent 5

Work is changing faster than ever before. Automation, artificial intelligence, and shifting global markets are redefining job roles, skill requirements, and even where and how we work. While these advances promise productivity and new opportunities, they also risk leaving behind workers and communities who are unprepared to adapt. Nearly 40% of global jobs are expected to be disrupted or transformed by automation in the next decade, with the greatest impact on routine and entry-level positions.

The future of work will be shaped by our ability to close the widening gap between the skills employers need and the training workers receive. Today, more than 50% of U.S. employers report difficulty finding qualified talent for open positions, even as millions of workers remain underemployed. These mismatches limit productivity and wages, slowing both individual advancement and economic growth. Addressing these challenges is essential not just to compete globally but to ensure shared prosperity at home.

Immigration is also central to the future of work, helping fill critical labor shortages in healthcare, technology, agriculture, and other essential industries. With an aging domestic workforce and declining birth rates in many regions, immigrant workers are often key to sustaining economic growth. Recent data show that immigrants have driven nearly half of U.S. workforce growth over the past decade. Leveraging immigration thoughtfully—through skills based visa programs, pathways to credential recognition, and equitable workforce integration—can strengthen competitiveness while meeting labor market needs.

Key Questions:

As AI automates routine tasks, which new skills and roles will be most in demand, and how can employers, educators, and policymakers collaborate to upskill existing workers quickly and effectively? Considering labor shortages in fields like healthcare, logistics, and advanced manufacturing, how can immigration policy and skills-based visa programs complement Ai driven workforce analytics to fill critical gaps? Will the demand for workers in the trade industries improve social mobility while upending the value of college degrees? How can immigration policy, skills-based visas, and faster credential recognition for foreign-trained workers help fill critical labor shortages and strengthen economic competitiveness?

Moderated by:

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Future-Proofing Health and Wellbeing reimagined with The Sheri and Les Biller Family Foundation

Location: Magnificent 7

Strong health and well-being are both markers of thriving societies and essential drivers of economic strength. Yet, chronic conditions, mental health challenges, and preventable diseases continue to strain healthcare systems and limit productivity. These challenges are even more pronounced in rural and low-income areas, where access to quality care and preventive resources lags significantly. Studies show that communities with limited access to healthcare can experience life expectancy gaps of more than 10 years compared to more affluent regions, underlining the urgent need for inclusive, scalable solutions. Globally, improving workplace health and well-being could unlock up to $11.7 trillion in economic value, highlighting the immense return on investing in people.

The path forward lies in expanding access to preventive care, addressing mental health openly, and building inclusive wellness systems that serve all communities—urban, suburban, and rural alike. Advances in technology, from telehealth platforms to mobile diagnostics and Ai powered health tools, are helping extend quality care to hard-to-reach populations.

Workplace wellness programs alone have been shown to return over $3 for every $1 invested through reduced healthcare costs and absenteeism, while closing the global women’s health gap could add $1 trillion annually to the global economy by 2040. This session will explore practical, future-focused strategies—from mobile clinics and digital health expansion to equitable policy design—that can close gaps in care, strengthen communities, and create a healthier, more resilient society for all.

Key Questions:

How can emerging technologies like AI, digital health platforms, and wearable devices help deliver preventive care and improve outcomes? In what ways can institutions ensure that investments in health and well-being are inclusive? What innovative strategies—such as mobile clinics, telehealth, or public-private partnerships—are proving most effective in expanding care? What models are successfully normalizing and integrating mental health support? What steps can communities, employers, and policymakers take to make health and well-being a foundation for long-term societal and economic resilience?

Moderated by:

3:00 PM | AFTERNOON PLENARY

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

4:00 PM | Future Proofing Finance

The future of finance is not merely about innovation — it’s about intention. As technology, demographics, and global markets evolve at unprecedented speed, the real challenge lies in ensuring that progress lifts everyone, not just those already positioned to benefit. To “future proof” finance is to design systems that are both resilient and just — where access and opportunity are not afterthoughts, but the foundation.

Today, over 1.4 billion adults worldwide remain outside the formal financial system, and in the United States, nearly one in three households is un- or underbanked. At the same time, global fintech investment now exceeds $150 billion annually, signaling both immense potential and a widening digital divide. The question becomes how do we not just innovate faster, but how can we innovate fairer — using data, AI, and digital infrastructure to democratize wealth creation rather than concentrate it.

Innovative leaders are showing what’s possible when major institutions place community at the center of innovation — investing in financial education, small business empowerment, and inclusive credit models that extend beyond traditional boundaries.

Banking has always been built on trust — yet we’re entering an era where consumers trust their phones more than their banks. How do traditional financial institutions restore and sustain trust in a world increasingly defined by digital platforms, fintech startups, and decentralized systems? We’ve seen enormous investment in digital banking and AI — but innovation doesn’t always equal inclusion. How do we ensure that technology expands access to credit and capital rather than reinforcing existing inequalities? What does “responsible innovation” look like inside a major financial institution? How do we measure performance in terms of community impact, financial health, and long-term stability? What structural or strategic changes do you believe are essential to make banks more adaptable, equitable, and resilient for the next decade? How do we keep the human element at the center of finance? What role should banks play in ensuring that consumers don’t just have access to tools, but also the knowledge and confidence to use them effectively.

Moderated by:

5:30PM | NETWORKING RECEPTION

WEDNESDAY, DECEMBER 3

7:00 AM | Registration Opens

FINAL AGENDA

8:00 AM | EXECUTIVE ROUNDTABLES

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Common Ground: Where Cultures Meet and Leaders Rise hosted by Tuskegee University and the Isreali Consulat

Executive Roundtable 1: Magnificent 7

Join Dr. Mark K. Brown, President of Tuskegee University, and Eitan Weiss, Consul General of Israel, for a conversation on TILE, the Tuskegee University Leadership Exchange, an innovative partnership designed to bring Black, Jewish and Israeli students together through shared learning, cultural immersion and collaborative leadership development.

TILE connects emerging leaders through travel in Israel, dialogue on identity and faith, and joint projects that explore the intersections of their experiences. Inspired by the historic cooperation between Booker T. Washington and Julius Rosenwald, the program seeks to renew a spirit of shared purpose and build relationships that can shape future coalitions for justice, education and opportunity.

They will be joined by Dr. Rolundus Rice, COO and Vice President of Student Affairs at Tuskegee University, and Aaron J. Braunstein, Director of Public Affairs at the Consulate General of Israel to the Southeastern United States. Closing remarks by Van Jones.

Future-Proofing Financial Inclusion: Credit Insights to Inform Expanding Economic Opportunity” hosted by FICO

Executive Roundtable 2: Magnificent 6

Join industry leaders for an intimate discussion on emerging credit trends that reveal both challenges and pathways to expanding economic opportunity for all Americans. Recent insights from FICO’s inaugural credit insights report show 90% of Americans are actively working to improve their financial health, yet generational divides and economic volatility create uneven access to credit and opportunity. In this roundtable, we will explore how shifting credit behaviors and consumer attitudes toward credit—from increased monitoring among younger generations to evolving payment priorities—should influence our approach to building inclusive economic systems. We’ll examine innovative strategies including enhanced credit education, accessible credit and financial management tools, and mission-driven lending partnerships that leverage alternative data to ensure the benefits of free enterprise reach underserved communities and future-proof economic mobility for all.

The Future-Ready Government: A Framework for Future-Proofing Policy, Technology & Community Wealth

Executive Roundtable 3: Magnificent 5

Hosted by State Representative Dexter Sharper and Naomie Delva, Legislative Advisor & Co-Founder, Delva & Sharper Consulting Group.

This invite-only executive roundtable, led by State Representative Dexter Sharper and Naomie Delva of Delva & Sharper Consulting Group, introduces leaders to a strategic blueprint for preparing government, business, and communities for rapid disruption. Using the FUTURE Framework™, the session explores how modernized policies, universal digital access, ethical technology integration, and workforce upskilling can strengthen community wealth and resilience. Sharper and Delva highlight how outdated systems create barriers for small businesses and vulnerable populations and how forward-thinking legislation and cross-sector partnerships can close those gaps. Participants will leave with clear, actionable steps to accelerate modernization, build equitable innovation, and position their communities for long-term success.

Georgia State Representative Dexter Sharper is the first African American elected as State Representative in the history of his city, and the youngest African American City Councilman & Mayor Pro-Tem to hold those offices.

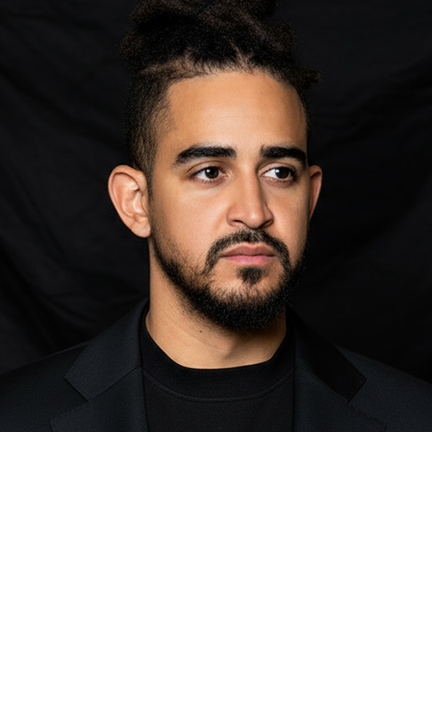

Master Class: Building a Powerful Digital Brand with Roland Martin

8:45 AM | MORNING PLENARY

Your Title Goes Here

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

11:05 AM | Future Proofing Philanthropy

Philanthropy is facing new pressures as communities deal with rising costs of living, rapid changes in technology, and growing gaps in access to opportunity. Preparing for the future means rethinking how charitable resources are used and how organizations can respond more quickly and effectively to real needs. Instead of relying on old models, the sector must focus on practical solutions that help people build stability and long-term well-being.

Data plays an essential role in this effort. The right information—used at the right time—can dramatically increase impact. Reliable data helps organizations spot problems earlier, direct funds where they matter most, and track whether programs are truly improving people’s lives.

Demographic changes also require new approaches. Older adults now make up about one-third of the U.S. workforce, many of whom face financial insecurity and limited access to digital tools or reskilling opportunities. At the same time, the skills people rely on for work are becoming outdated more quickly, sometimes within just a few years. Philanthropy must plan for these long-term realities by supporting education, employment pathways, and services that keep pace with people’s evolving needs.

Technology presents both challenges and opportunities. Artificial intelligence, for example, is already influencing how people work and learn. A recent $1 billion commitment to developing AI tools for frontline workers shows that philanthropy can help test new ideas and make innovation more accessible. The goal is not just to embrace new tools, but to ensure they are used in ways that widen access and help people gain stability, not fall behind.

Future-proof philanthropy focuses on what genuinely improves lives: strong community partnerships, clear evidence of what works, and a willingness to try new approaches when old ones fall short.

Key Questions:

- How can philanthropy use data more effectively to identify real community needs and avoid relying on outdated assumptions about what works?

- What investments today will matter most over the next decade as older adults make up a growing share of the workforce and require new forms of support?

- How can philanthropic organizations balance the need to address immediate crises with the responsibility to plan for long-term, systemic challenges?

- How can funders work more closely with community partners to ensure resources reach people and places that traditional systems often overlook?

- As tools like artificial intelligence become more common, what safeguards and strategies are needed to ensure these innovations expand access rather than deepen existing inequalities?

- How can philanthropy better identify and support community problem-solvers who already have effective solutions but lack the resources to scale their work?

Moderated by:

12:25 PM | CLOSING PLENARY